The information below consists of general information on how to purchase municipal securities and other general information relating to municipal securities and securities issued by LADWP. This website is not an offer to sell or solicitation of an offer to buy bonds or notes. Bonds or notes may only be purchased through an Official Statement and a broker.

- For certain offerings, individual investors get to place their orders before institutional investors, such as mutual funds or insurance companies.

- They earn the same investment return as institutional investors who buy the same bonds or notes.

- They do not pay the upfront brokerage fee/commission. (Individuals should check with their broker to learn about any other transaction or account maintenance fees.)

Step 1 – Have a brokerage account

- You must have an account with one of the brokerage firms participating in the bond or note sale. Bonds and notes cannot be purchased directly from the LADWP. If you do not have an account at one of the participating firms, you may open one and purchase bonds or notes during the early order period. (If you have a brokerage account, go to Step 2.)

- Investors are encouraged to begin the New Account process well in advance of the sale. Depending on the brokerage, internal new account procedures may take some time to process.

- Each firm has its own requirements for opening an account. The LADWP does not endorse any particular brokerage firm. Additionally, the LADWP does not guarantee that any one of these firms will open an account for an investor.

Step 2 - Learn about the bonds or notes

- Bonds or notes can only be offered through an Official Statement. Download and read the Preliminary Official Statement to learn about the bonds or notes, including their security, maturity dates, the types of projects they finance and other information you may find important to help you make an informed investment decision. This website is not an offer to sell any bonds or notes.

- Find out the credit ratings LADWP bonds or notes have received (Link).

Step 3 – After careful review and a decision to buy bonds or notes, place your order

- Contact the broker with whom you have an account, either online or by phone, to get more information about how to buy bonds or notes during the early order period.

Tax-exempt means that, in the opinion of legal counsel, the interest you earn on the security is exempt from federal income taxes and from State of California personal income taxes. Investors should consult their brokers or other financial advisors to obtain comparisons between tax-exempt LADWP municipal bonds or notes and taxable investment alternatives. Not all LADWP bonds are tax-exempt. For additional information about the tax status of specific bonds, read the “Tax Matters” section of the official statement for that particular offering. Official statements may be obtained by clicking here.

Municipal bonds and notes can be an important part of a diversified investment portfolio. Because bonds and notes typically have a predictable stream of payments of principal and interest, many people invest in them to preserve and increase their capital, or to receive dependable interest income. Additionally, the interest earned on municipal securities typically is exempt from federal and state income taxes.

It is important to remember that investment objectives, and the best strategies for achieving those objectives, depend on an individual investor’s particular circumstances. The tax advantage investors reap from tax-exempt securities will vary according to their income level.

- Credit Risk - Risk that the issuer is unable to pay scheduled principal and interest on a timely basis. To evaluate the credit quality of an issuer, examine its credit rating and review the Preliminary Official Statement of the offering, which contains detailed financial information of the issuer.

- Interest Rate Risk - When interest rates decrease, bond and note prices increase, and when interest rates increase, bond and note prices decrease. Interest rate risk is the risk that changes in interest rates may reduce (or increase) the market price of a security. For investors who anticipate to own a bond or note until its maturity, interest rate risk is not a concern.

- Security Specific Risks - Specific risks relating to an individual LADWP security can be found in the Official Statement relating to such security.

- Interest Rate - The LADWP pays interest to investors in exchange for the use of the loaned money. The interest rate is a percentage of the principal (the amount borrowed), accruing over a specified period. Interest on bonds or notes with fixed interest rates typically is compounded and paid semiannually. Interest on bonds or notes with variable interest rates accrues at a rate which changes periodically based on specific criteria.

- Price - The price is the amount investors are willing to pay based on certain variables, including current market yields, supply and demand, credit quality, maturity and tax status. Keep in mind that price and yields move in opposite directions. When market yields increase, the value of a bond or note decreases, and vice versa.

- Yield - The yield generally refers to the return an investor earns on the bond or note. The yield may take into account a number of factors including purchase price, interest rate, market price, par value, maturity date, and the time between interest payments. Investors should consult their brokers or other financial advisors to learn more about yield.

- Maturity - Maturity is the date when the principal on the bond or note is scheduled to be repaid to the investor. The LADWP generally sells bonds that have maturities between 1 and 30 years. In general, the further out the maturity date, the higher the investor’s yield.

- Redemption Provisions - Some bonds or notes contain provisions that allow the LADWP to redeem, or “call,” all or a portion of the bonds or notes, at specific prices, prior to their maturity dates. Bonds frequently are called when interest rates are lower than when the LADWP sold the bonds. Bonds or notes with redemption provisions usually offer investors higher yields to compensate for the risk that the bonds might be called early. When the LADWP calls a bond or note, it pays the holder the principal amount and any interest earned since the last interest payment. However, the holder does not receive the interest that would have been earned if the bond had been allowed to reach its maturity date. Holders of callable bonds or notes are notified of impending calls. Investors can find out if their LADWP bond or note has been called by calling Investor Relations Section at (213) 367-4562. Investors should have their CUSIP (Committee on Uniform Securities Identification Procedures) number – a unique identifying number – available when calling.

- Creditworthiness - Most municipal bonds and notes are rated by one or more of the three major rating agencies: Fitch Ratings, Moody’s Investors Service, and Standard & Poor’s. A credit rating is an independent assessment of the creditworthiness of the bonds. It measures the probability of timely repayment of principal and interest of a bond or note. Higher credit ratings indicate the rating agency’s view that there is a greater probability the investment will be repaid. For the LADWP’s bond ratings, please click here.

Most municipal securities may be sold prior to maturity with the assistance of a brokerage firm. If an investor sells a municipal security prior to maturity, he or she may receive more or less than the original price depending on prevailing market interest rates, supply and demand, and perceived credit quality of the securities, among other variables. In addition, investors should consult a tax advisor for any tax implications.

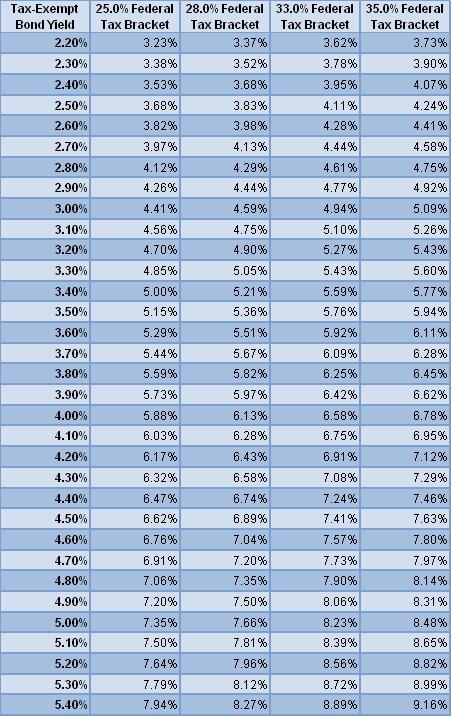

The taxable equivalent yield is the return on a taxable investment that makes it equal to the return on a tax-exempt security of the same credit quality. The table below shows the taxable equivalent yield for a range of tax-exempt yields based on different federal tax brackets and the 9.3% California State tax bracket.

Taxable Equivalent Yields

The Securities Industry and Financial Markets Association (SIFMA) maintains a calculator on its website (www.investinginbonds.com) that computes the taxable equivalent yield of a tax-exempt security, depending on an individual’s State and Federal income tax bracket.

When an issuer sells a new issue, it is referred to as a primary market sale. In a new issue, all of the terms are set, including the price and interest rates, and the securities are sold to investors, with the issuer receiving the proceeds of the sale. The initial sales commission paid to broker-dealers is paid by the issuer, such as the LADWP, from the proceeds. A retail investor who would like to participate in a primary market transaction must have an account with, and purchase the securities through, a brokerage firm serving as one of the issuer’s underwriters or selling group members.

A secondary market transaction does not involve the issuer, but is a transaction between two investors – a buyer and a seller. Secondary market transactions involve a brokerage firm which acts either as a liaison between the buyer and seller, or as a buyer or seller itself. Buyers pay sales commissions to brokerage firms to compensate them for their services in facilitating the transaction. Market conditions, such as prevailing interest rates, supply and demand, and credit quality, among other variables, determine the price, which likely will differ from the original price.

Revenue bonds are a form of long-term borrowing by the LADWP to finance the Water System and the Power System capital improvements programs such as improving reliability, water quality, building or improving water projects and generation facilities, etc. The interest payments and repayment of principal at maturity for the Water System bonds and the Power System bonds will be from revenues generated by respective system.

Consult the Official Statement for the specific LADWP security to find information about the source of funds available to pay debt service on such security. The LADWP bonds are special obligations of LADWP payable only from specified funds held by LADWP and not out of any other fund or moneys of LADWP or the City of Los Angeles. The LADWP bonds do not constitute or evidence an indebtedness of the City of Los Angeles or a lien or charge on any property or the general revenues of the City of Los Angeles. Neither the faith and credit nor the taxing power of the City of Los Angeles are pledged to the payment of any LADWP bond.